Open Enrollment Questions? We've Got You Covered!

Everything you need to know during the open enrollment period.

It’s that time of year, open enrollment. Where millions of workers and retirees choose a new insurance plan or continue with current coverage. Selecting an insurance plan can be confusing and even frustrating. HMO, PPO? What’s the difference? We all have questions and Helix Virtual Medicine is here to help!

First let’s start with a few things to consider when selecting a new plan:

Premiums: The amount you or employer pay for your health insurance every month. Employers often pay a share of their employee’s premium, reducing the cost significantly for the employee, but keep in mind that amounts may vary based on plan types and employer demographics. Be careful to choose your plan wisely and remember that a lower premium doesn’t always equate to the best value and can often result in a higher deductible.

Co-pay: The fixed amount you pay each time you use your health insurance, whether that’s seeing a doctor or refilling a prescription. Basically, the cost not covered by insurance.

Deductible: The amount you pay out-of-pocket before your insurance company contributes their amount. Having an insurance plan with a deductible means that you are responsible for 100% of all your medical costs until your deductible is met. Be sure to choose a plan with an affordable deductible. This will usually result in a higher monthly premium, but will pay off when you need to use your healthcare benefits.

Co-insurance: The percentage you and your health insurance plan pay for health care services once your deductible is met.

Out-of-pocket maximum: 99% of employees with single coverage choose a plan with an out-of-pocket maximum.

Network: We often hear the term in-network when discussing the topic of health insurance. This refers to the Provider network of healthcare Providers and hospitals that are covered by our insurance. If you have established relationships with your healthcare Providers, being in-network is an important component to consider.

In short, when deciding on a plan, it’s important to consider how much you want to pay upfront in a premium vs. how many benefits you want covered later on by your insurance and whether having an in-network will matter to you and your family.

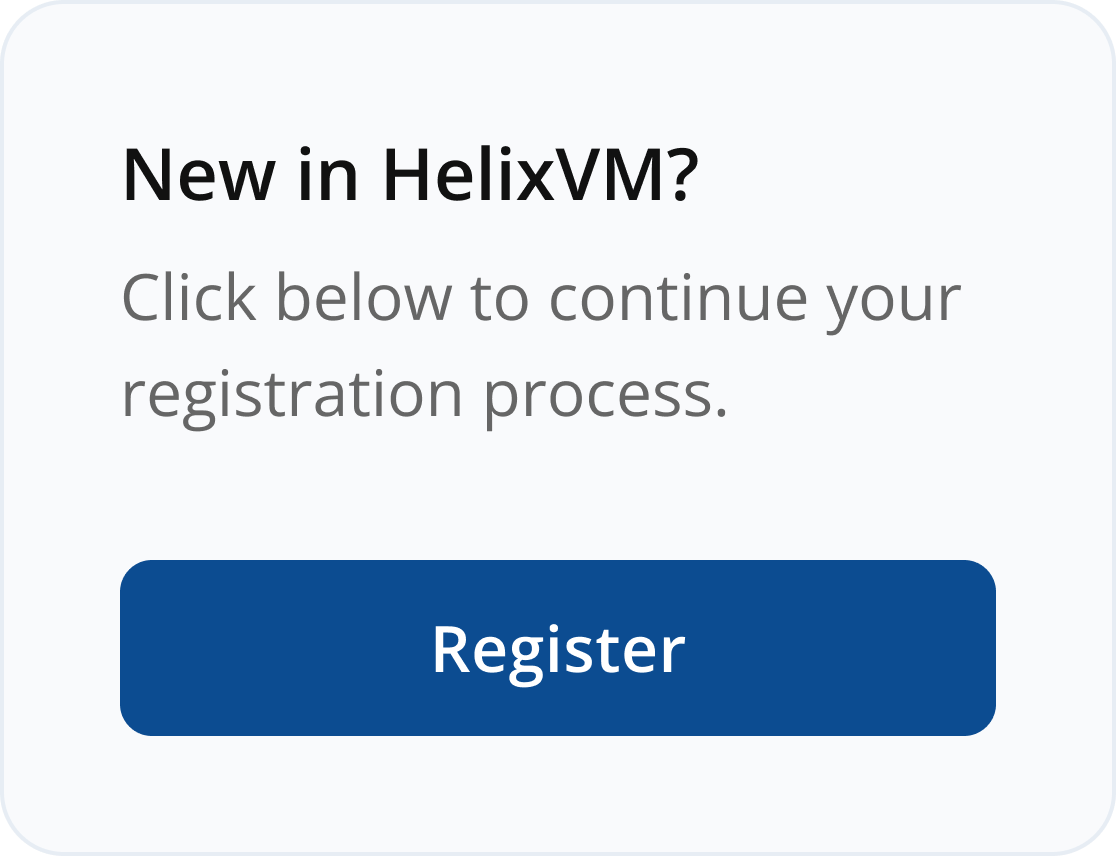

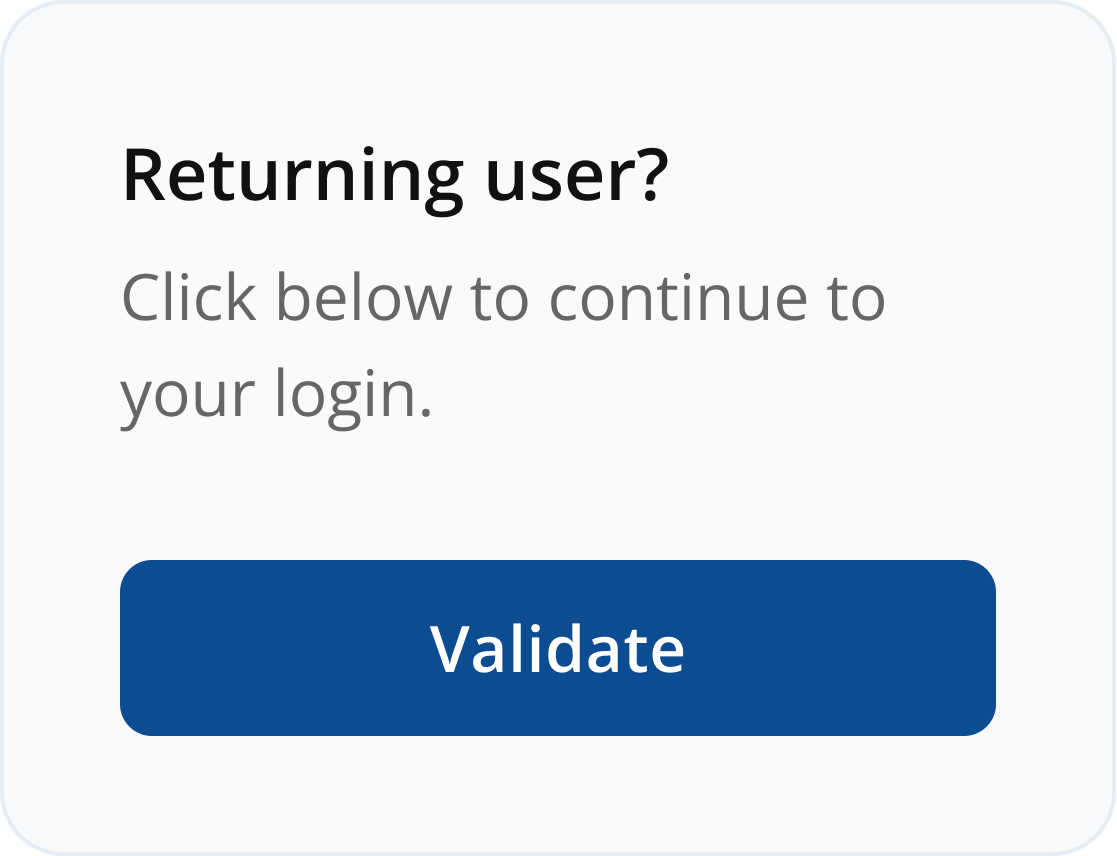

Selected your insurance and ready for a virtual visit? Click here to get started.